We sponsored The Financial Brand Forum 2022, the biggest conference on digital growth strategies in the banking world. We talked to a lot of our happy customers from the financial industry as well as with many people from financial institutions who are interested in growing their digital presence and building the best digital experiences for their clients. We also listened to the conference talks. Here are a few key takeaways from the event, which can be inspirational not only for banking and finance industry leaders but also for others who want to increase their company’s digital experience maturity.

Face your digital denial

I’ll leave out some of the great and inspirational talks from keynote speakers like Magic Johnson, Alison Levine, or Daymond John, and I will focus on the takeaways connected with innovation and digital growth. My reason for this is down to “digital denial”, which is impacting the whole market, not just the banking and financial sector.

James Robert Lay from the Digital Growth Institute defined “digital denial” as a state of mind when a person can see that the world around them is changing, transforming towards a more digitalized version, but they deny that they need to change themselves and their approach. If this denial relates to your work as a marketer responsible for the growth of your company’s assets, it’s very dangerous for your career and for your company’s results.

To be able to fight your digital denial, you need to realize that you need to change your way of thinking and be able to innovate. And while innovation is on the list of top priorities for 97% of CEOs (according to the PWC study presented by Jeremy Gutsche from Trend Hunter), their employees face a lot of obstacles to innovate.

Duncan Wardle, former Head of Innovation & Creativity at Disney and Innovation Professor at Yale University, presented three top barriers for innovation:

- Lack of time available for innovative thinking

- Fear of new ideas (both having them and presenting them in the company)

- Company KPIs focusing on bringing repetitive quarterly results

These three barriers are forcing us to stay in our current stage of “river thinking”, how Duncan calls it. Or you can call it “path dependency”, which is a similar term from Jeremy Gutsche describing how much we tend to stay in past path thinking without even realizing it.

Stop for a moment and embrace some of the tactics from Duncan. Start reacting to the ideas of your colleagues and team members by “Yes, and …” instead of “No, because …” Ask yourself the question “What if …” to challenge the rules of your industry. Or bring the “Naive Expert”, someone who’s not from your industry and is not afraid to ask dumb questions, to get you out of your “river thinking”. Because, to quote Duncan, “If you know the answer, you are iterating. You don’t want to iterate. If the idea scares you, you are innovating.”

And realize one more thing: “Your competitors are lazier than you think.” Thank you, Jeremy, for reminding us.

What do you know about your customers? Hug Your Haters

If you embraced the need to digitally innovate your business and communication, it’s time to understand your customers’ needs and their journey, so you can focus on the right touchpoints. As Lincoln Parks puts it: “You can’t have predictable growth if you haven’t first documented how strangers become prospects, prospects become customers, and customers become raving (and referring fans) …”

Roll-up your sleeves, go out, and talk to people. In the end, it does not matter if you are in B2B or B2C. Omar Johnson, former CMO at Beats by Dre and former VP Marketing at Apple, called it B2H: Business to Human. Start solving human problems and talk to real people to be able to build your message.

And while it’s important to connect and communicate with your customers, it’s not just your happy ones. Jay Baer introduced his concept of ‘Hug Your Haters’ which really reinforced the notion that you can learn a lot from unhappy customers. His six-piece framework and new book Hug Your Haters: Embrace Complaints and Keep Your Customers takes a closer look at customer service and retention, which is fundamental to outflanking your competitors. Inspire yourself with his framework and take a look at the immediate reaction of our CEO, Dominik Pinter, after Jay’s presentation:

Assess your digital experience maturity to prepare the plan

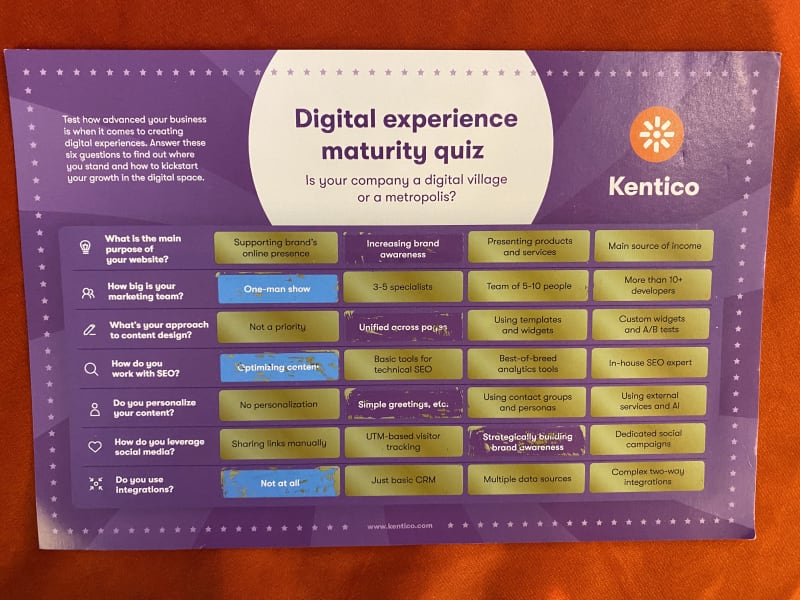

When you understand your customers’ needs and their journey, it’s time to assess yourselves. Digital experience maturity is key to maximizing your marketing efforts and marketing tech stack. Measuring digital experience maturity allows businesses to determine how digitally sophisticated they are, which DXP features are the best fit for them, and the order in which they should consider adopting new features.

During the event, banks, financial institutions, and credit unions had a chance to get a real flavor of their level of digital experience maturity. With a digital experience maturity scratch card (which was available in tote bags), many attendees kick-started their digital experience maturity discovery, and those that visited the team at the Kentico booth were able to dive a little deeper.

Armed with a calculator that uses a set of questions based on marketing capabilities, approach to content design, and size of marketing teams etc. the Kentico team assessed and provided immediate recommendations on digital maturity. If you missed your chance, it’s not too late, you can still calculate your level of digital experience maturity.

Ask “Who can help me to do more as a marketer?”

After assessing your current state of digital experience maturity, it’s time to take action and improve it. But how can you do it smart way and exponentially when your competitors’ budgets and capacities are bigger than yours?

James Robert Lay talked about the mantra of not asking how but who can help you do more as a marketer in today's world. The important metric for him is not ROI, but ROT – Return on Time. What is the value of your one hour in today’s digital and AI time? You need to change your mindset and instead of thinking about how you can incrementally change the way you work; you should embrace the question of who can change your work exponentially. And the answer is that modern digital AI tools can do it for you.

So, what tools should you choose to exponentially increase your capacities and capabilities without overspending? It’s more important than ever for organizations to choose a vendor that is all in and ready to support marketing success with the right people and technology.

At Kentico, we believe that coupled with the power of AI, smart unified tools can eliminate digital denial and drive exponential growth through digital experience maturity. Watch my reaction on James’ talk:

Measure ROI and ROT

After implementing changes and new tools into your digital marketing growth strategy, do not forget to measure the impact. Derek Barka and Jim Pannos from our partner agencies SilverTech and Pannos Marketing talked about the ways to start measuring ROI with limited capacities during their Lunch&Learn session.

If there’s one takeaway you should remember from their inspirational talk, it’s that “effective marketing is a continual evolution.” You should:

- Execute

- Measure

- Analyze

- Optimize

- and start again from point 1

But don’t forget to define your business goals first. At Kentico, we do offer a service of regular syncs with our Customer Success Management team, or you can rely on our strong partner network to help you define and achieve the business goals with a unified and flexible digital experience platform for your digital growth.

Leveraging the takeaways

So there it is. Five key takeaways can be summarized as: digital denial, hug your haters, digital experience maturity, doing more as a marketer, and measuring ROI. If you’re thinking about how to improve your customer experience, diving deeper into these areas is a good starting point.

And if you’re a leader in banking reading this, why not check out our ebook for finance leaders. You’ll learn why security and compliance, must-have marketing capabilities, flexibility, built-in customer data platform, quick ROI and 24/7 global support and services are just some of the reasons why customers globally like TowneBank, Value Line, BPAY and The Global City choose Kentico.

Further reading

Subscribe to the Kentico Xperience newsletter

You'll receive our newsletter once a month with all the updates you need to know to keep you in the loop with the Kentico Xperience community. Just the hits—guaranteed.